ASM is pleased to announce conditional finance support from Export Finance Australia (EFA) to secure A$ 200 million of debt funding for its Dubbo Rare Earths Project in Central NSW.

EFA has advised that it will commence detailed due diligence of the Dubbo Project, in line with the agency’s mandate to support eligible Australian projects with targeted debt solutions to supplement private market finance.

ASM Managing Director David Woodall said the Dubbo Project’s alignment with the objectives of the Australian Government’s Critical Minerals Strategy – to diversify global critical mineral supply and capture more value from the critical minerals value chain – would be a key factor in a successful application to secure Australian government financing.

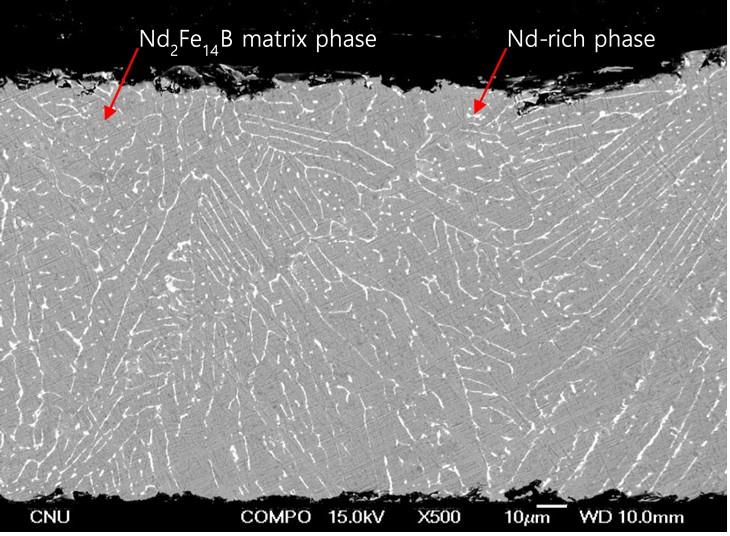

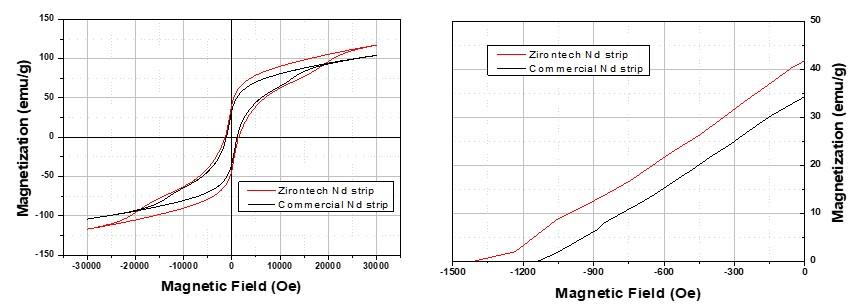

“The critical metals we will produce from the Dubbo Project – including zirconium, niobium and hafnium, and the rare earth elements neodymium, praseodymium, terbium and dysprosium – are all in high demand for a suite of modern industrial applications, including energy-efficient technologies, electric vehicles, aerospace, defence and telecommunications,” Mr Woodall said.

“We are developing an integrated “mine to metals” business, which will be unique in that we will take all project products from the mine and manufacture them at our Korean and global metals plants into critical metals, alloys and powders that can be used directly by hi-tech industries.”

As outlined in EFA’s non-binding letter of support, a successful outcome from the EFA assessment and due diligence process is contingent on a number of conditions, summarised below:

- securing offtake commitments for metal products, which diversify critical metal supply chains;

- execution of a lump sum turnkey fixed date contract with an acceptable engineering contractor for the engineering, construction and commissioning of the Project;

- finalising the Project’s funding plan including the raising of equity and securing funding from other lenders;

- meeting eligibility criteria, credit and risk requirements, including, but not limited to, EFA’s “know your customer” and anti-bribery requirements and checks; and

- the Project receiving the required regulatory and environmental approvals.

“The Dubbo Project is ready for construction, with all major State and Federal approvals and licences in place,” Mr Woodall said.

“Our discussions with potential offtake, equity and financing partners in the Dubbo Project have been very positive and are continuing. We look forward to updating the market as this progress.”