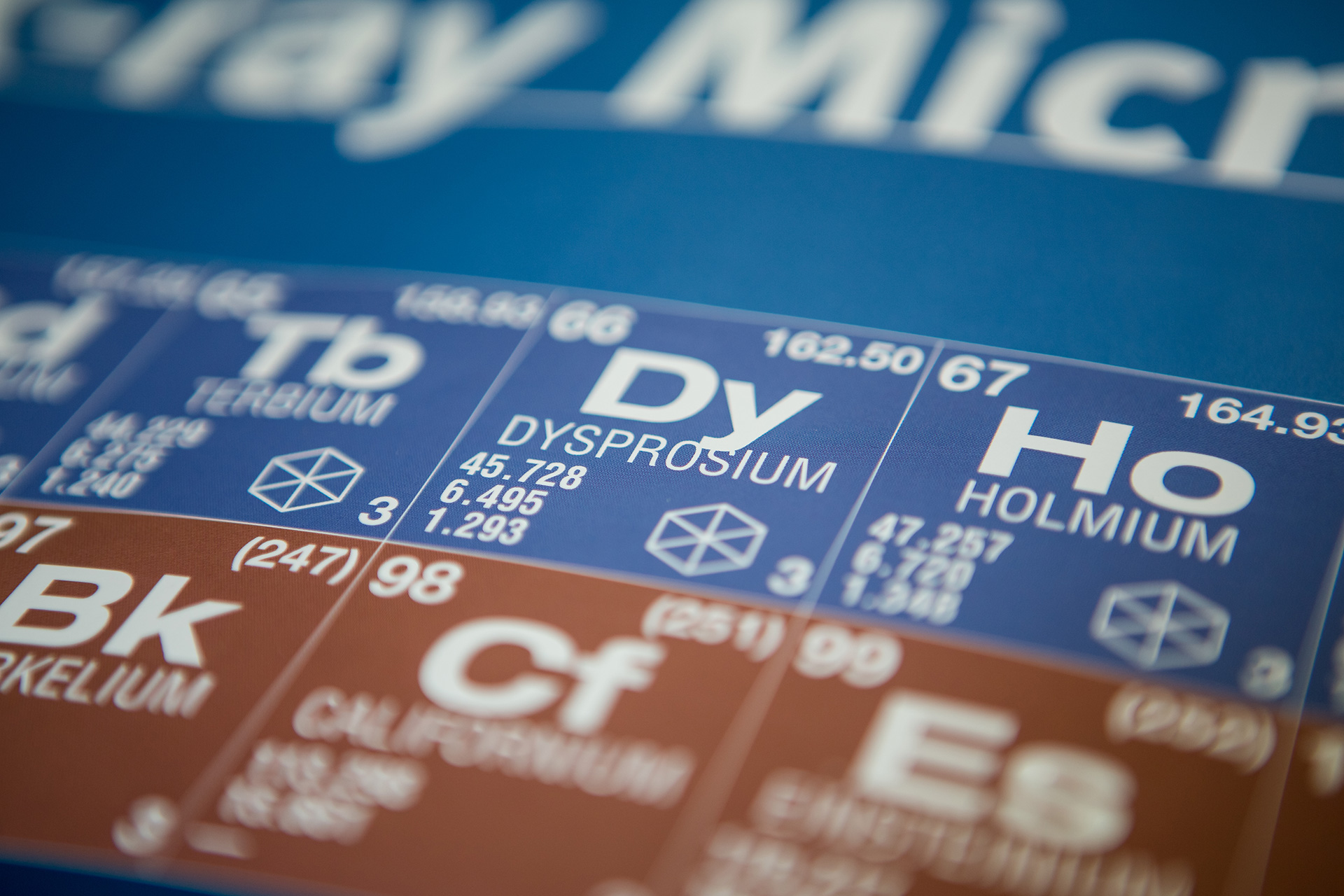

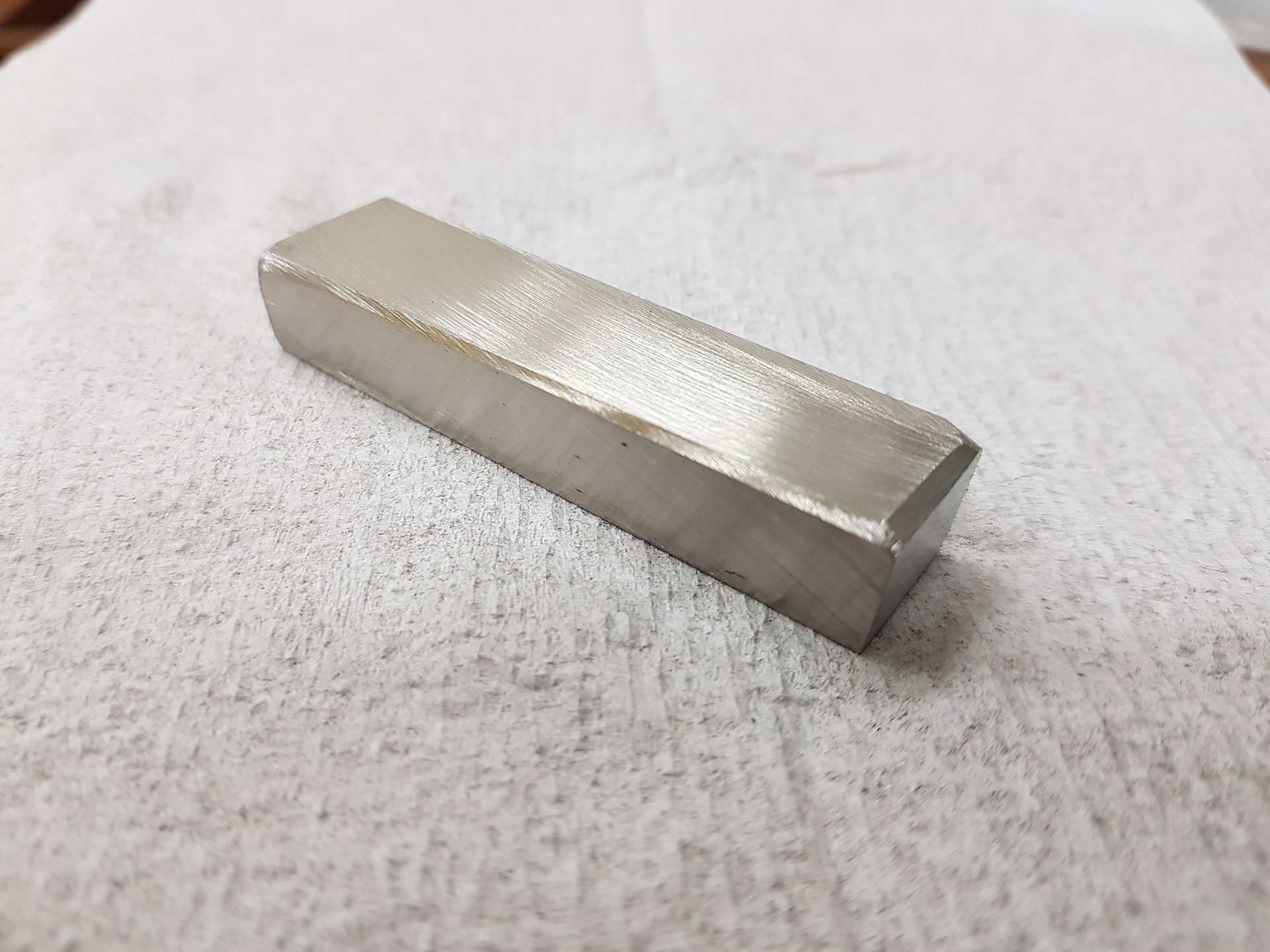

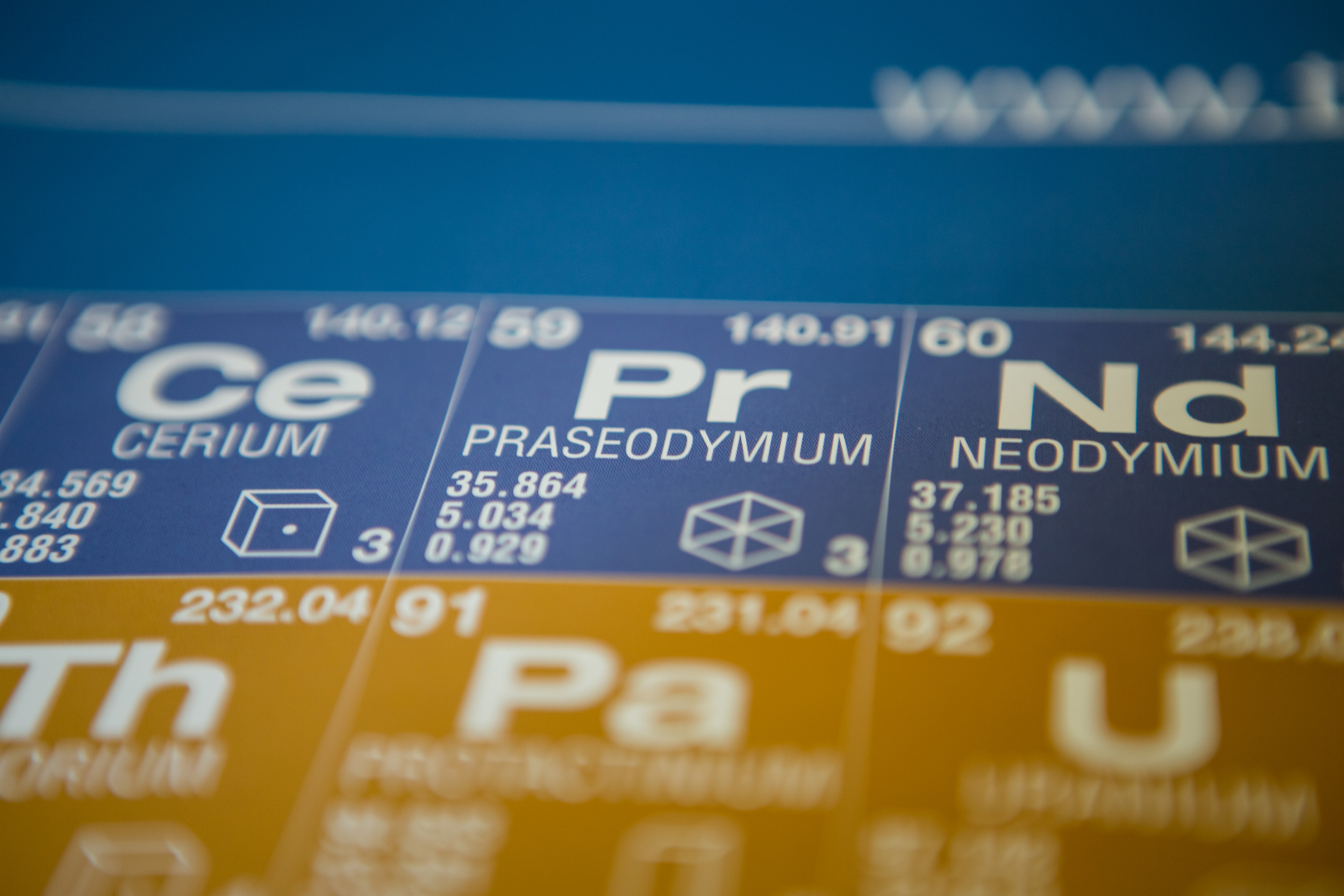

ASM is pleased to announce excellent results from its latest terbium (Tb) and dysprosium (Dy) heavy rare earth (RE) separation test work. The results confirm the design capability of the Dubbo Project’s advanced process flowsheet to produce high purity Tb and Dy oxides at industry leading product quality.

The pilot plant test work was conducted by ANSTO, Australia’s Nuclear Science & Technology Organisation. Results show the process is capable of producing Tb and Dy oxide product streams that meet or exceed target specifications of >99.99% for Tb and > 99.95% for Dy, at steady state.

“These excellent results demonstrate the strength of ASM’s advanced technical capability. Producing both light and heavy rare earth oxides at high purity sets the Dubbo Project and ASM apart and allows us to offer industry leading product quality to our offtake partners.”

Rowena Smith, ASM Managing Director and CEO

Highlights

Highlights

Highlights

Highlights

Highlights:

Highlights:

Highlights:

Highlights:

Highlights:

Highlights:

Highlights:

Highlights: