ASM announces the Company’s pro-rata non-renounceable entitlement offer (Entitlement Offer) of new ordinary shares in the Company (New Shares), closed on 16 April 2021 and proceeds of $26,919,096 have been raised pursuant to the Entitlement Offer.

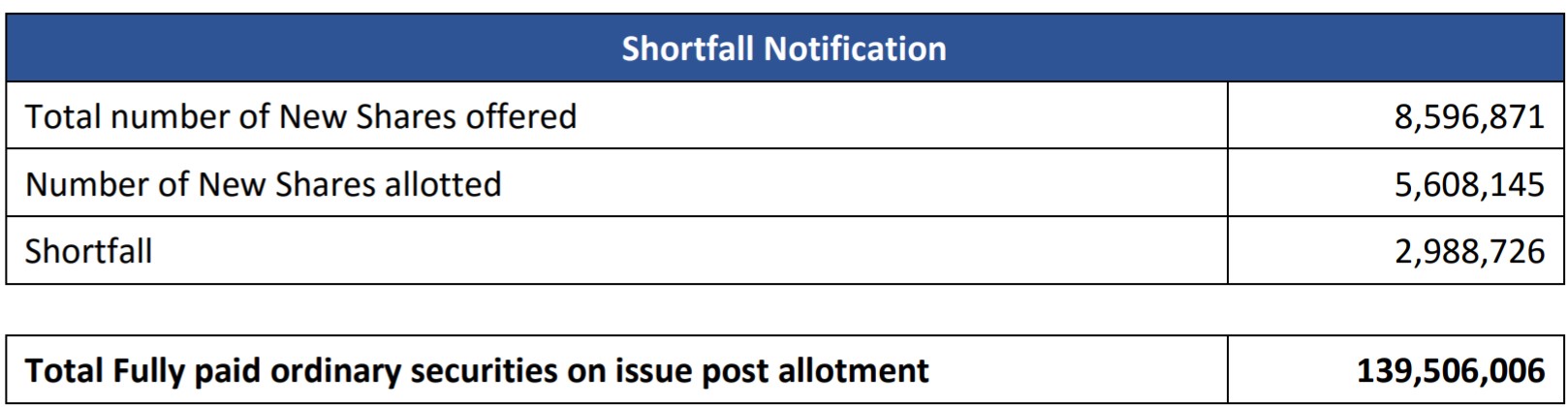

The Company received applications from eligible shareholders for 5,608,145 New Shares at the issue price of $4.80 per New Share, representing an approximate 65.23% take-up. Together with the placement to institutional and sophisticated investors of $65,000,000 (refer ASX release 26 March 2021), the gross proceeds under the capital raising are $91,919,096 (Capital Raising). The placement to institutional and sophisticated investors completed on 6 April 2021.

The proceeds of the Capital Raising will be used to provide funding for ASM to focus on advancing key workstreams including engineering and development of the Korean Metals Plant (KMP) and the FEED Study for the Dubbo Project, while also providing additional working capital and funding of corporate costs.

Managing Director, David Woodall stated “This Capital Raising builds on the momentum that ASM has generated through the technical milestones achieved since listing in July last year. The funds raised will cover important work on both the KMP and the Dubbo Project as ASM advances its critical metals strategy.”

The Directors wish to thank shareholders for their continued support of the Company, and again welcome new shareholders who participated in the Capital Raising.

New Shares are expected to be issued on Friday, 23 April 2021, with normal trading of the new shares expected to begin on Monday, 26 April 2021.

ASM maintains the flexibility to place shortfall under the entitlement offer but has made no decision to do so at this stage.

For further information regarding the Offer please contact Company Secretary, Dennis Wilkins, on +61 8 9227 5677 or via email at dennis@dwcorporate.com.