ASM is pleased to announce that the Company has received firm commitments from sophisticated, professional and institutional investors for the placement of approximately 13.5m fully paid ordinary shares (New Shares) at $4.80 per New Share, raising $65m in gross proceeds (Placement).

Managing Director, David Woodall, commented: “We are delighted to have completed the placement component of this raising from existing and new international and Australian institutional investors. I am very pleased to welcome new shareholders to the Company, who join our register at a truly exciting time as we finalise plans to develop our first metallisation facility in Korea.

The funds raised significantly bolster our balance sheet, placing the Company in a strong position as we progress key workstreams which include the development of the proposed Korean Metals Plant and advancing key FEED workstreams on the Dubbo Project in New South Wales.

Importantly, we continue to advance our strategy for sustainable growth, with a primary focus on developing ASM into a globally relevant, independent and integrated metals producer by 2022.”

Highlights

- Firm commitments received to raise approximately $65m through Placement at $4.80 per share

- Strong international and domestic demand, with several high-quality institutions participating in the Placement

- Funds raised from the Placement significantly strengthens ASM’s existing cash position, with further funds expected to be raised from the Entitlement Offer

- Proceeds provide funding for ASM to focus on advancing key workstreams including engineering and development of Korean Metals Plant and the FEED Study for the Dubbo Project, while also providing additional working capital and funding of corporate costs

- 1 for 14 Entitlement Offer will now proceed, at the same pricing as the Placement, to raise up to a further $41m, with some of ASM’s largest shareholders committing to take up approximately 29.4% of entitlements under the Entitlement Offer

The Placement

A total of 13,541,667 New Shares will be issued under the Placement at a price of $4.80 per New Share (Offer Price) under ASM’s ASX Listing Rule 7.1 placement capacity.

New Shares issued under the Placement will rank equally with existing ASM ordinary shares. The Offer Price represents a discount of:

- 4% to the Company’s last closing price on 23 March 2021 of $4.99; and

10% to the 5-day volume-weighted average price of $5.35.

Settlement of the Placement is scheduled to occur on Thursday, 1 April 2021.

Entitlement Offer

ASM is also undertaking a 1 for 14 pro-rata non-underwritten, non-renounceable entitlement offer to eligible shareholders to raise up to approximately a further $41m (before costs) (Entitlement Offer).

Eligible shareholders as at the Record Date of Wednesday, 31 March 2021, with a registered address in Australia or New Zealand, will be invited to participate in the Entitlement Offer at the Offer Price (being the same price as the Placement). The Entitlement Offer is expected to open on Wednesday, 7 April 2021, and close at 5pm (Perth time) on Friday, 16 April 2021, unless extended. As the Entitlement Offer is non-renounceable, entitlements will not be tradable or otherwise transferable.

Certain large shareholders (including ASM’s largest shareholder Abbotsleigh Proprietary Limited) who hold a combined voting power of 29.4% have committed to take up their full pro-rata entitlements under the Entitlement Offer, totalling approximately $12m.

The terms and conditions and further details of how to participate in the Entitlement Offer will be set out in the Offer Booklet which is expected to be sent to eligible shareholders on Wednesday, 7 April 2021. The Offer Booklet will include a personalised entitlement and acceptance form. Copies of the Offer Booklet will also be available on the ASX and the Company’s website.

Proceeds from the Placement and Entitlement Offer will be primarily used as follows:

- To fund the final stage of engineering and construction of ASM’s proposed Korean

Metals Plant (KMP); - Further engineering (FEED) work in relation to the Dubbo Project in NSW;

- Corporate costs; and

- Working capital and offer costs.

Timetable

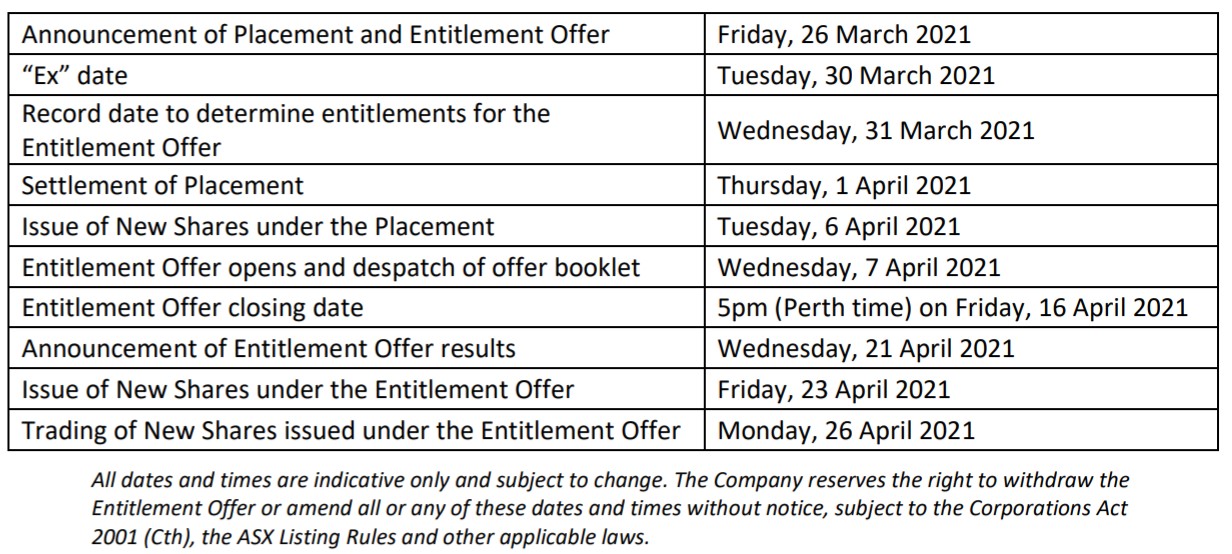

The indicative timetable for the Placement and Entitlement Offer is set out below: