We are pleased to advise our Quarterly Activities Report to 30 June 2024 has been released.

In line with ASM’s strategic business priorities, this Quarter, the Company:

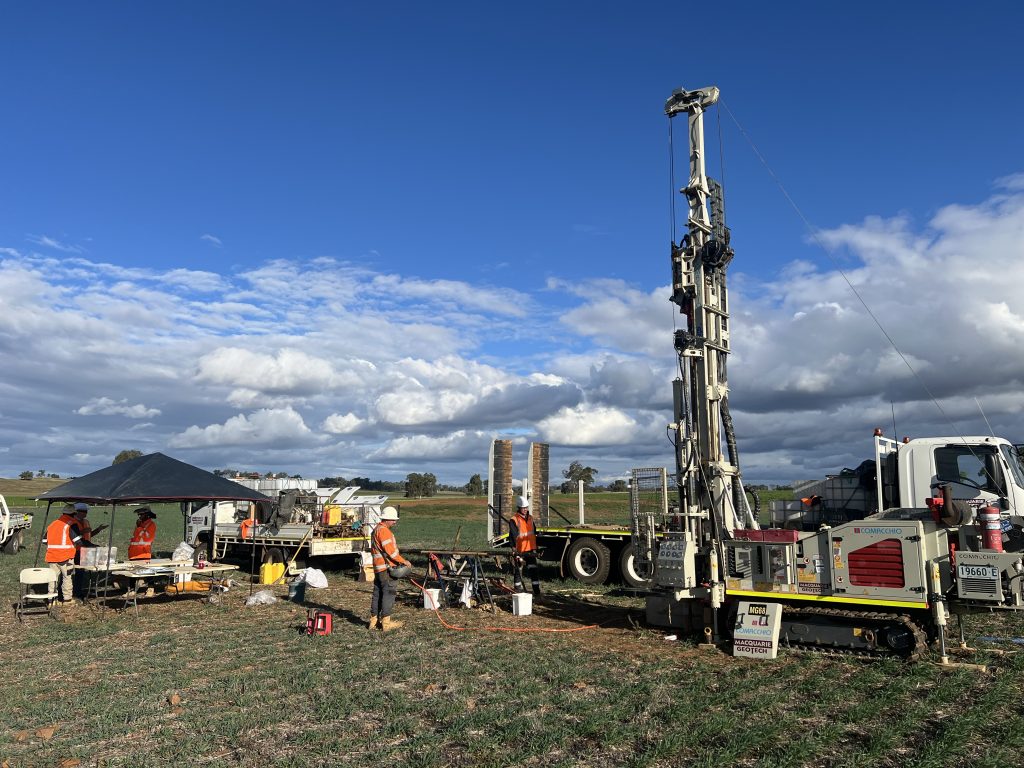

- Delivered several successful optimisations of the flowsheet and design of the Dubbo Project. These included demonstrating a simplified flowsheet design for the production of high-purity hafnia and identifying economic benefits in an alternative niobium oxide circuit. The Company commenced testwork on an alternative circuit for rare earth production (RE Options Assessment) which will continue for the remainder of CY2024. These significant achievements highlight the Dubbo Project’s capacity to produce products that meet growing global demand and identify promising opportunities to reduce both capital and operating expenditures;

- Executed an Option Agreement with Caspin Resources Limited to provide ASM with an option to earn up to 75% of the rare earth element rights in Caspin’s Mount Squires Project through staged earn in rights;

- Strengthened its balance sheet by completing a capital raising consisting of an institutional placement and rights issue to raise ~A$16.6 million which positions ASM to undertake activities for progression of final stage engineering for the Dubbo Project in 2024; and

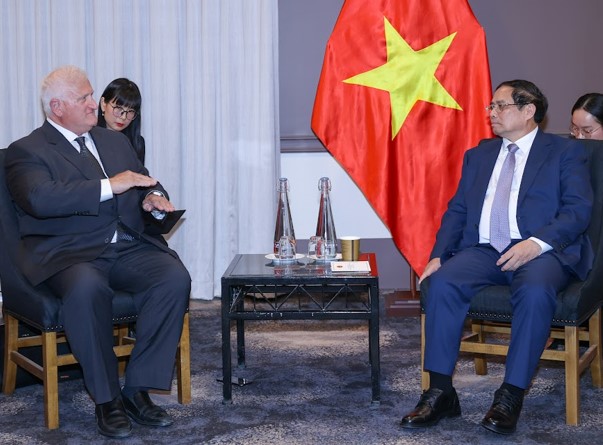

- Received a non-binding and conditional Letter of Interest from Export Development Canada to provide a debt funding package of up to A$400 million for the construction and execution phase of the Dubbo Project.